When embarking on your entrepreneurial journey, determining how much funding you need, what for, and how much you’re actually eligible for is crucial. Here are some of the most common types of financing.

Sweat equityYou’re likely your own first investor—most often, this means with your own money and labour. The value of your sweat equity proves to potential funders that you’re committed and willing to take risks. In fact, some investors require that up to 25% be invested by the entrepreneur. Always keep track of the time and assets you put in.Love money

This is money contributed by family or friends. When accepting this type of funding, always clarify its terms to avoid confusion down the line: is it a gift or a loan? Will interest be charged? Do they want equity?Grants, contests

While grants and contests are worth pursuing, there is usually strong competition, and the criteria are often very strict. As such, they’re not a reliable funding source, as there are only a chosen few who make the cut. If you apply for a grant, be sure to make your application count!Loans

Loans can come from many different sources—try to find government and foundation loan programs that encourage entrepreneurship in more meaningful ways, such as with Futurpreneur, or the BDC. Strong applications that meet all criteria are generally successful.Tax credits, subsidies

Tax credits are available to those hiring or training certain groups (i.e. summer interns), and wage support programs such as STA or SAJE can help the unemployed start businesses.Angel investors, venture capitalists

These are equity investors looking for big returns, so it will cost you, though it may be worth it. An angel investor is a successful entrepreneur interested in money but who may also want to give back. Venture capitalists are strictly interested in money (think Dragons’ Den) and are suited to businesses already past their ‘seed stage’.Pre-sales

A pre-sales plan involves leveraging all channels (i.e. ads, social media, email) to sell your product or service before it’s publicly available, which can in turn boost your cash flow and your credibility by showing that you have paying customers.Crowd funding

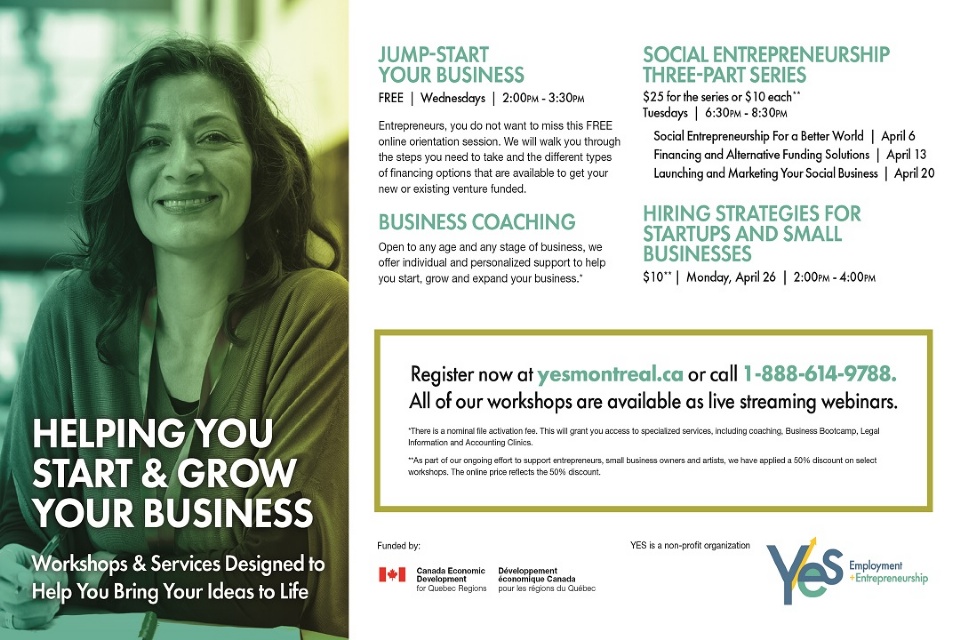

Crowdfunding platforms like Kickstarter, Indiegogo, LaRucheQuebec.com and GoTroo are a financing alternative that can facilitate online fundraising before your product or service is actually out there. This takes the form of many small contributions rather than a single large one.YES Business Coaches can help you decide which types of financing work best for your business. Visit yesmontreal.ca.

In The Latest Issue:

In The Latest Issue:

BY:

BY:

Tweet

Share