Maxed out your RRSP and TFSA contribution room?

Would you like to take advantage of tax deferred compounding?

Would you rather pay tax on capital gains instead of interest income?

If so, keep reading.

Aside from market volatility, one of the biggest obstacles to investment growth is taxes.

Your investments are very important, so it’s essential to find a vehicle that allows the potential to grow without being eroded by taxes.

This is easier to achieve when you’re investing in a tax-advantaged plan such as an RRSP or TFSA. But what about those non-registered dollars that don’t benefit from the attractive tax advantages of their registered counterparts?

We have a tax-efficient solution for you; CORPORATE CLASS FUNDS.

Did you know that whether you have investments in your business account, non-registered accounts or both, the tax efficiency of your portfolio is almost as important as the investments themselves?

Corporate Class Funds have existed for almost 30 years but unfortunately are not very well known to the average investor.

Corporate Class Funds can help you build and adjust your non-registered investment portfolios by switching among classes without immediately triggering taxes. This can provide you with the flexibility you need to meet your changing investment objectives without triggering immediate tax consequences. More of your money stays invested and less goes to the tax man.

Long-term tax-deferred compounding is very powerful and can result in more money to your retirement savings or to use towards other financial goals for your portfolio.

HOW CORPORATE CLASS FUNDS CAN WORK FOR YOU OVER TIME

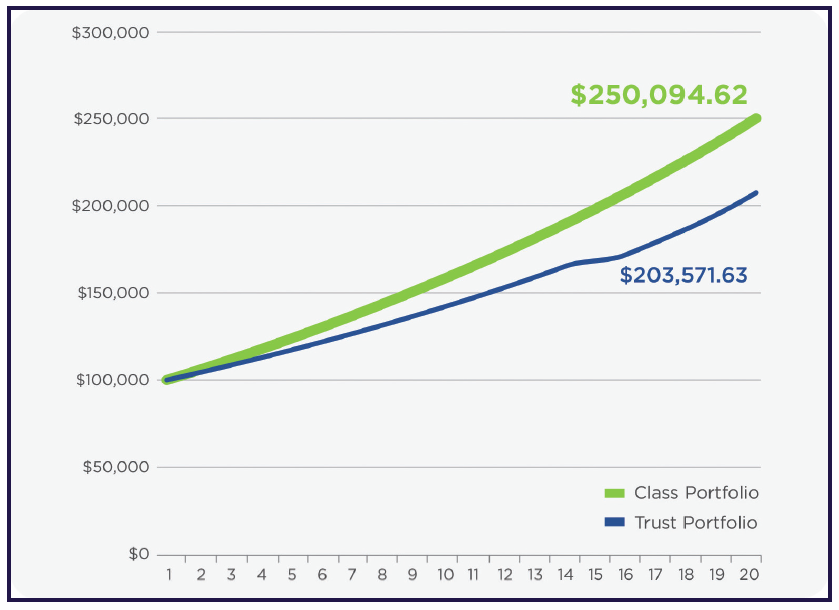

The below graphic illustrates the hypothetical returns of two non-registered portfolios.

One is made up of Mutual Fund Trusts, the other of Corporate Class Funds.

Both portfolios maintain identical asset mixes and rebalance every five years.

This hypothetical scenario assumes (1) a $100,000 initial investment portfolios consisting of 80<>percentage<> equity and 20<>percentage<> fixed income switching to 60<>percentage<>/40<>percentage<> after 5 years, 40<>percentage<>/60<>percentage<> after 10 years and 20<>percentage<>/80<>percentage<> after 15 years, and (2) annual return of 6<>percentage<> on equity and 4<>percentage<> on fixed income for an average annual portfolio return of 4,71<>percentage<>. This scenario assumes capital gain inclusion rate of 50<>percentage<>, a marginal tax rate of 46,41<>percentage<> and corporate tax rate of 39.50<>percentage<>. In this hypothetical situation, the Corporate Class portfolio accumulates $46,523 (22.85<>percentage<>) more than the traditional Trust portfolio.

This publication is intended to provide general information only and any illustration used in this publication has been included only to help clarify the information presented. Before you act on any of the information contained in this publication, make sure you seek advice from a qualified professional that will conduct a thorough examination of you specific situation.

Reprinted with permission of Dynamic Funds. Commission, trailing commisions, management fees and expense all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed their values change frequently and past performance may not be repeated. Sponsored in part by Dynamic Funds.

In The Latest Issue:Latest Issue:

In The Latest Issue:Latest Issue:

- A Bittersweet Farewell

- The new Laval Aquatic Co...

- The End of an Era:

Articles

Calendar

Virtual- ANNUAL TEACHER APPRECIATION CONTEST

- APPUI LAVAL

- ARTS & CULTURE

- CAMPS

- CAR GUIDE

- CCIL

- CENTENNIAL ACADEMY

- CHARITY FUNDRAISING

- CITYTV

- COSMODÔME

- COMMUNITY CONNECTIONS

- COVER STORY

- DINA DIMITRATOS

- ÉCOLE SUPÉRIEURE DE BALLET DU QUÉBEC

- EDITORIALS

- ÉDUCALOI

- EDUCATION

- EMPLOYMENT & ENTREPRENEURSHIP

- FÊTE DE LA FAMILLE

- FÊTE DU QUARTIER SAINT-BRUNO

- FAMILIES

- FESTIVAL LAVAL LAUGHS

- FÊTE DE QUARTIER VAL-DES-BRISES

- FINANCES

- GLI CUMBARE

- GROUPE RENO-EXPERT

- HEALTH & WELL-BEING

- 30 MINUTE HIT

- ANXIETY

- CHILDREN`S HEALTH & WELLNESS

- CLOSE AID

- DENTAL WELLNESS

- EXTREME EVOLUTION SPORTS CENTRE

- FONDATION CITÉ DE LA SANTÉ

- GENERAL

- HEARING HEALTH

- MESSAGES FROM THE HEALTH AGENCY OF CANADA

- MENTAL HEALTH

- SEXUALITY

- SOCIAL INTEGRATION

- SPECIAL NEEDS

- TEENS

- THE NUTRITION CORNER

- THE NUTRITION CORNER - RECIPES

- VACATION DESTINATION

- WOMEN'S FITNESS

- WOMEN'S HEALTH

- HILTON MONTREAL/LAVAL

- HOME & GARDEN

- INTERNATIONAL WOMEN'S DAY

- JAGUAR LAVAL

- LAVAL À VÉLO

- LAVAL FAMILIES TV SHOW

- LAVAL FAMILIES MAGAZINE CARES

- LAVAL URBAN IN NATURE

- LE PARCOURS DES HÉROS

- LES PETITS GOURMETS DANS MA COUR

- LEON'S FURNITURE

- LEONARDO DA VINCI CENTRE

- LFM PREMIERES

- LIFE BALANCE

- M.P. PROFILE

- MISS EDGAR'S AND MISS CRAMP'S SCHOOL

- MISSING CHILDREN'S NETWORK

- NETFOLIE

- NORTH STAR ACADEMY LAVAL

- OUTFRONT MEDIA

- PASSION SOCCER

- PARC DE LA RIVIÈRE-DES-MILLE-ÎLES

- PÂTISSERIE ST-MARTIN

- PIZZERIA LÌOLÀ

- PLACE BELL

- PORTRAITS OF YOUR MNA'S

- ROCKET DE LAVAL

- SACRED HEART SCHOOL

- SCOTIA BANK

- SHERATON LAVAL HOTEL

- SOCIÉTÉ ALZHEIMER LAVAL

- STATION 55

- STL

- SUBARU DE LAVAL

- TECHNOLOGY

- TEDXLAVAL

- TODAY`S LAURENTIANS AND LANAUDIÈRE

- TODAY`S LAVAL

- WARNER MUSIC

- THIS ISSUE

- MOST RECENT

Magazine

TAX-EFFICIENT INVESTING AT ITS BEST

Articles ~e 105,7 Rythme FM 4 chemins Annual Teacher Appreciation Contest Appui Laval Arts & Culture Ballet Eddy Toussaint Camps THIS ISSUE MORE...

CONTESTS Enter our contests

CONTESTS Enter our contests

CALENDAR

Events & Activities

COMMUNITY Posts Events

PUBLICATIONS Our Magazine Family Resource Directory

LFM BUSINESS NETWORK Learn more

COUPONS Click to save!

COMMUNITY Posts Events

PUBLICATIONS Our Magazine Family Resource Directory

LFM BUSINESS NETWORK Learn more

COUPONS Click to save!

SUBSCRIPTIONS

Subscribe to the magazine

Un-Subscribe

E-NEWSLETTER Subscribe to our E-newsletter Un-Subscribe

WRITE FOR US Guidelines & Submissions

POLLS Vote today!

E-NEWSLETTER Subscribe to our E-newsletter Un-Subscribe

WRITE FOR US Guidelines & Submissions

POLLS Vote today!

ADVERTISERS

How to & Media guide

Pay your LFM invoice

SUGGESTIONS Reader's Survey Suggest a Listing

LFM About Us Our Mission Giving Back Contact Us

SUGGESTIONS Reader's Survey Suggest a Listing

LFM About Us Our Mission Giving Back Contact Us

PICK-UP LOCATIONS

Get a copy of LFM!

PICK-UP LOCATIONS

Get a copy of LFM!

TERMS & CONDITIONS Privacy | Terms

ISSN (ONLINE) 2291-1677

ISSN (PRINT) 2291-1677

Website by ZENxDESIGN

BY:

BY:

Tweet

Share